Table of Contents

The Ultimate Guide to Building Your Emergency Fund

The Ultimate Guide to Building Your Emergency Fund

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

- Understanding the Why:

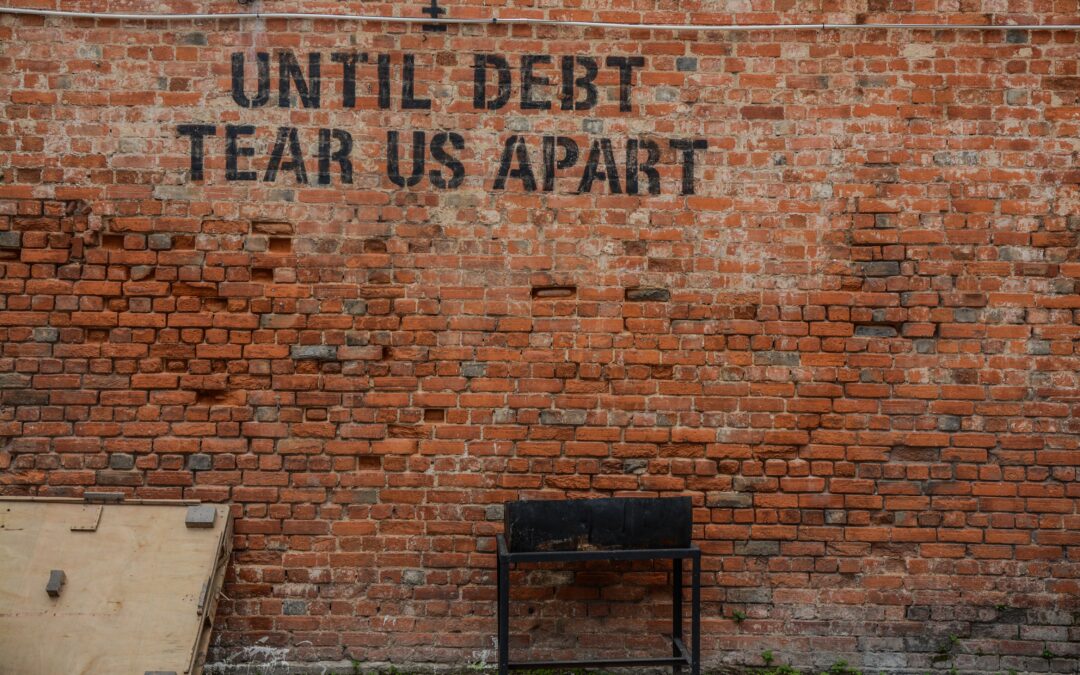

Before diving into the how, it’s crucial to understand why having an emergency fund is essential. From unexpected medical bills to sudden car repairs, life’s curveballs can hit hard. An emergency fund ensures you’re financially prepared for these surprises, providing a buffer to navigate through tough times without compromising your financial stability.

- Set a Realistic Goal:

Start by setting a realistic goal for your emergency fund. A common recommendation is three to six months’ worth of living expenses. This amount can vary based on your individual circumstances, such as job stability, family size, and monthly commitments. Determine what makes you feel secure and work towards that target.

- Create a Budget:

Building an emergency fund requires a clear understanding of your income and expenses. Create a realistic budget to track where your money is going each month. Identify areas where you can cut back on non-essential spending to allocate more funds to your emergency fund.

- Start Small, But Start Now:

Building an emergency fund may seem daunting, but the key is to start small. Set aside a small percentage of your income each month, and gradually increase the amount as your financial situation improves. The important thing is to establish the habit of consistently saving for emergencies.

- Choose the Right Account:

Selecting the right account for your emergency fund is crucial. Opt for a savings account that offers a competitive interest rate and easy access to your funds. This ensures that your money is growing, albeit modestly, and is readily available when you need it.

- Automate Your Savings:

Make building your emergency fund a seamless process by setting up automatic transfers. This ensures that a portion of your income is consistently directed towards your emergency fund without requiring constant manual intervention. Automation makes it easier to stick to your savings plan.

- Windfalls and Bonuses:

Use unexpected windfalls, such as tax refunds or work bonuses, to boost your emergency fund. While it might be tempting to splurge on non-essential items, allocating a portion of unexpected income to your emergency fund accelerates your progress.

- Review and Adjust:

Life is dynamic, and your financial situation may change. Regularly review your budget and adjust your savings goals accordingly. If your income increases or decreases, update your emergency fund target to reflect your current circumstances.

Building an emergency fund is a crucial step towards achieving financial security. By setting realistic goals, creating a budget, and consistently saving, you’ll be well on your way to creating a financial safety net that can weather life’s storms. Remember, it’s not about how much you save at once, but the habit of saving regularly that counts. Start building your emergency fund today, and take a significant step toward a more financially secure future.

The Ultimate Guide to Building Your Emergency Fund

Learn more about how Copiafy can help you plan for financial success www.copiafy.com.