Table of Contents

Learn How to Save Money Now (Before You Really Need It)

Learn How to Save Money Now (Before You Really Need It)

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Saving money isn’t just about preparing for the unexpected; it’s a habit that can pave the way for financial freedom. In this article, we’ll explore practical and easy-to-follow tips on how to save money now, ensuring you’re building a secure financial future, even before you really need it. Embrace the power of savings as a path to financial liberty.

- Set Clear Savings Goals: Define specific objectives for your savings, such as an emergency fund, vacation, or significant future purchase.

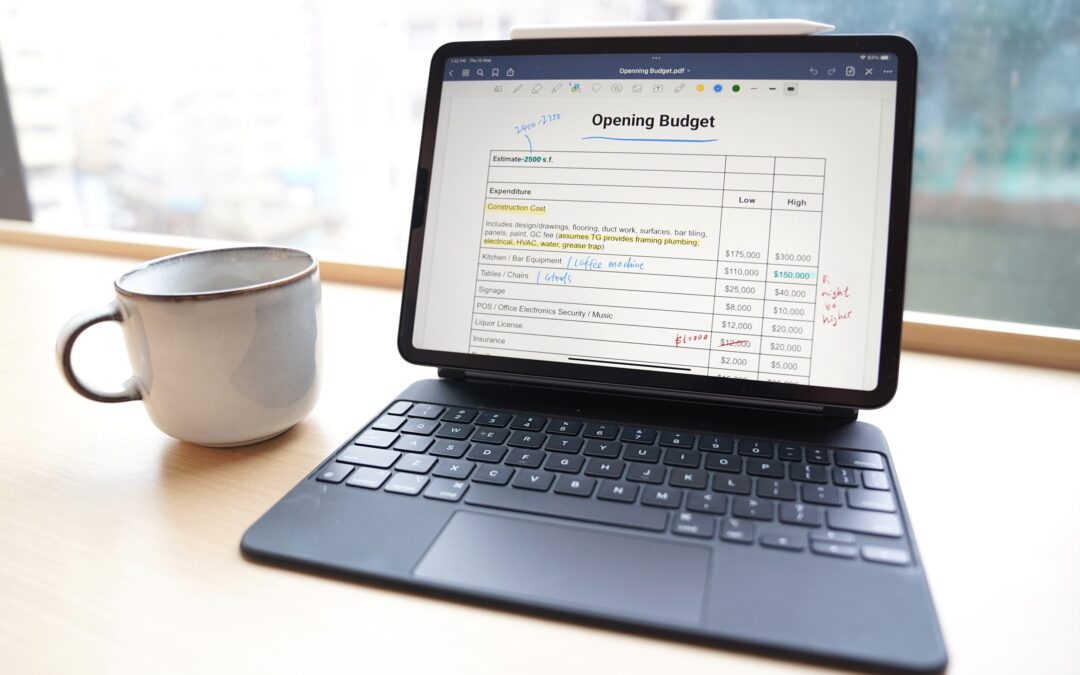

- Create a Realistic Budget: Outline your income and expenses, focusing on truthful assessment of needs versus wants, and ensure savings are a fixed component of your budget.

- Automate Your Savings: Implement automatic transfers to your savings account to make saving a hassle-free and consistent practice.

- Cut Unnecessary Expenses: Identify and reduce non-essential spending in areas like dining out, unused subscriptions, or luxury purchases.

- Discounts and Coupons Utilization: Actively seek and use discounts and coupons to save on various purchases without sacrificing quality or enjoyment.

- Building an Emergency Fund: Accumulate a fund covering several months’ worth of expenses for financial security in unexpected situations.

- Side Hustles for Extra Income: Explore additional income sources through side jobs or freelance work to boost your savings.

- Negotiate Monthly Bills: Actively negotiate with service providers to lower your regular bills, leading to immediate savings.

- Smart Shopping Techniques: Adopt mindful shopping practices like price comparisons, bulk buying, and taking advantage of sales.

- Continuous Financial Education: Stay informed about personal finance and savings methods to enhance your saving strategies.

Kickstart your journey to financial well-being with these practical saving tips. By establishing clear goals, crafting a realistic budget, and incorporating these strategies into your everyday life, you lay the groundwork for a financially secure future. Remember, the essence of savings lies in starting small and maintaining consistency; each saved penny today is a stride towards your financial freedom tomorrow.

Learn How to Save Money Now (Before You Really Need It)

Learn more about budgeting and saving with Copiafy www.copiafy.com