Table of Contents

7 Practical Budgeting Tips for Financial Success

7 Practical Budgeting Tips for Financial Success

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

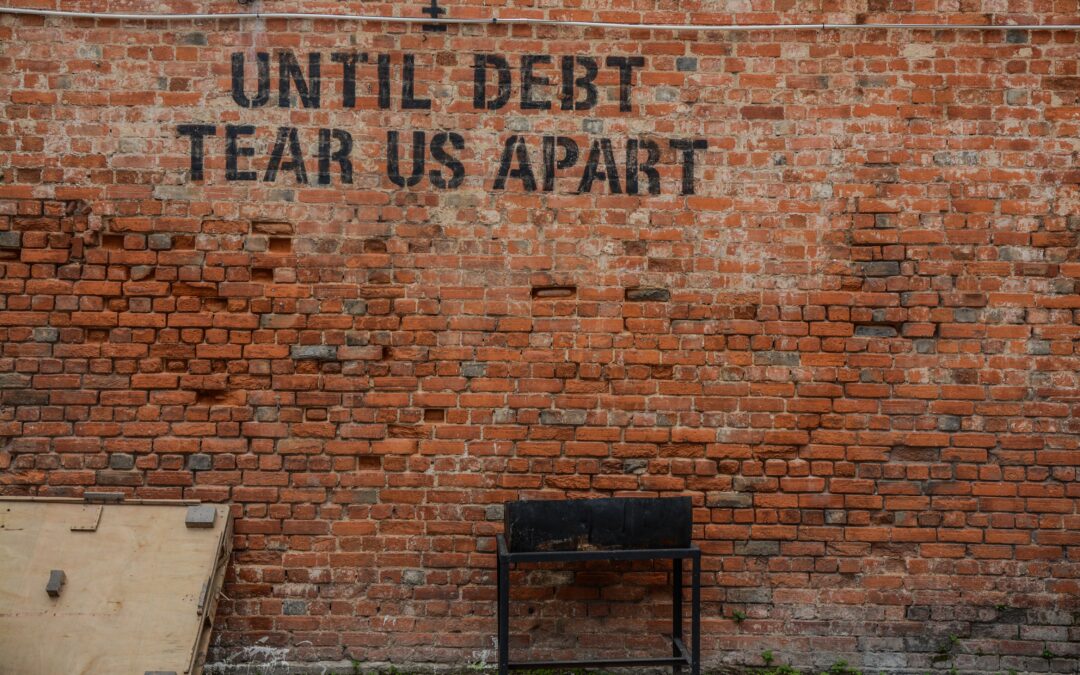

Budgeting is a powerful tool that can transform the way you manage your money. With practical and straightforward strategies, you can take control of your finances and work towards your financial goals. In this article, we’ll explore seven practical budgeting tips to help you achieve lasting financial success.

- Track Your Expenses: Begin by recording all expenditures, from bills to minor purchases, to gain insight into your spending patterns.

- Create a Realistic Budget: Develop a budget that reflects your spending habits, segregate expenses into fixed and variable categories, and ensure it aligns with your income and lifestyle goals.

- Prioritize Savings: Treat savings as an essential expense, setting aside funds for various goals before other expenditures.

- Cut Unnecessary Expenses: Examine your spending to identify and eliminate superfluous costs, which can cumulatively lead to substantial savings.

- Envelope Budgeting for Variables: Use the envelope system for variable expenses to physically limit spending and maintain better control.

- Budgeting Apps: Employ technology, like budgeting apps, to streamline the budgeting process, track progress, and set goals.

- Review and Adjust Regularly: Keep your budget dynamic, revising it as needed to reflect changes in your life circumstances and financial status.

Mastering budgeting is an attainable goal with these practical strategies. By conscientiously tracking expenses, prioritizing savings, and leveraging technological aids, you’ll cultivate habits for enduring financial success. Budgeting is an evolving process that guides you towards fiscal prudence and stability.

7 Practical Budgeting Tips for Financial Success

Learn more about budgeting and money management with Copiafy www.copiafy.com.