Table of Contents

5 Common Money Mistakes New Graduates Should Avoid

5 Common Money Mistakes New Graduates Should Avoid

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

As you toss your graduation cap into the air and step into the world of adulthood, managing your finances becomes a crucial skill. Avoiding common financial pitfalls is key to securing a stable future. Here are five key financial mistakes that new graduates should be aware of to navigate post-graduate life successfully.

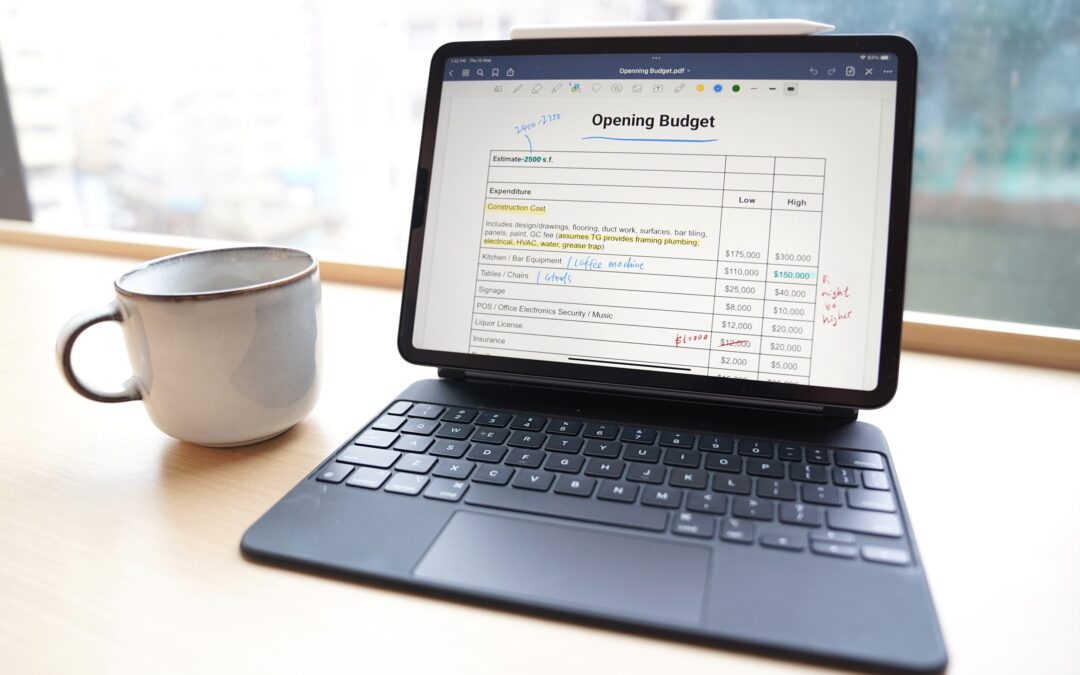

- Ignoring a Budget:

Mistake: Neglecting to create a budget can lead to overspending and financial stress.

Solution: Craft a realistic budget that outlines your income, expenses, and savings goals. This foundational tool will help you manage your money effectively and ensure you’re living within your means.

Overlooking the creation of a budget can lead to uncontrolled spending. Establish a budget that tracks income, expenses, and savings goals, ensuring you live within your means.

- Neglecting an Emergency Fund:

Mistake: Overlooking the importance of an emergency fund can leave you financially vulnerable when unexpected expenses arise.

Solution: Prioritize building an emergency fund that covers three to six months’ worth of living expenses. This financial safety net provides peace of mind and protection against unforeseen circumstances.

- Mismanaging Credit Cards:

Mistake: Racking up credit card debt or making late payments can harm your credit score and lead to financial headaches.

Solution: Use credit cards responsibly by paying your balance in full each month. Monitor your spending, stay within your credit limit, and pay bills on time to build a positive credit history.

- Overlooking Retirement Savings:

Mistake: Delaying contributions to retirement accounts may result in missed opportunities for compound growth over time.

Solution: Start saving for retirement early, even if it’s a small amount. Take advantage of employer-sponsored retirement plans or consider opening an individual retirement account (IRA) to set yourself up for a comfortable future.

- Failing to Negotiate Salaries:

Mistake: Accepting job offers without negotiating your salary can impact your long-term earning potential.

Solution: Research industry standards, know your worth and don’t hesitate to negotiate your salary or benefits. This can have a significant impact on your financial trajectory throughout your career.

As a new graduate, the financial landscape might seem daunting, but by avoiding these common mistakes, you can pave the way for a stable and prosperous future. Budget wisely, prioritize savings, use credit responsibly, plan for retirement, and don’t shy away from negotiating your worth. Taking these steps early on will set you on the path to financial success and empower you to make informed decisions throughout your financial journey.

5 Common Money Mistakes New Graduates Should Avoid

Learn More with Copiafy www.copiafy.com