Table of Contents

A Step-by-Step Guide on How to Create a Family Budget

A Step-by-Step Guide on How to Create a Family Budget

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

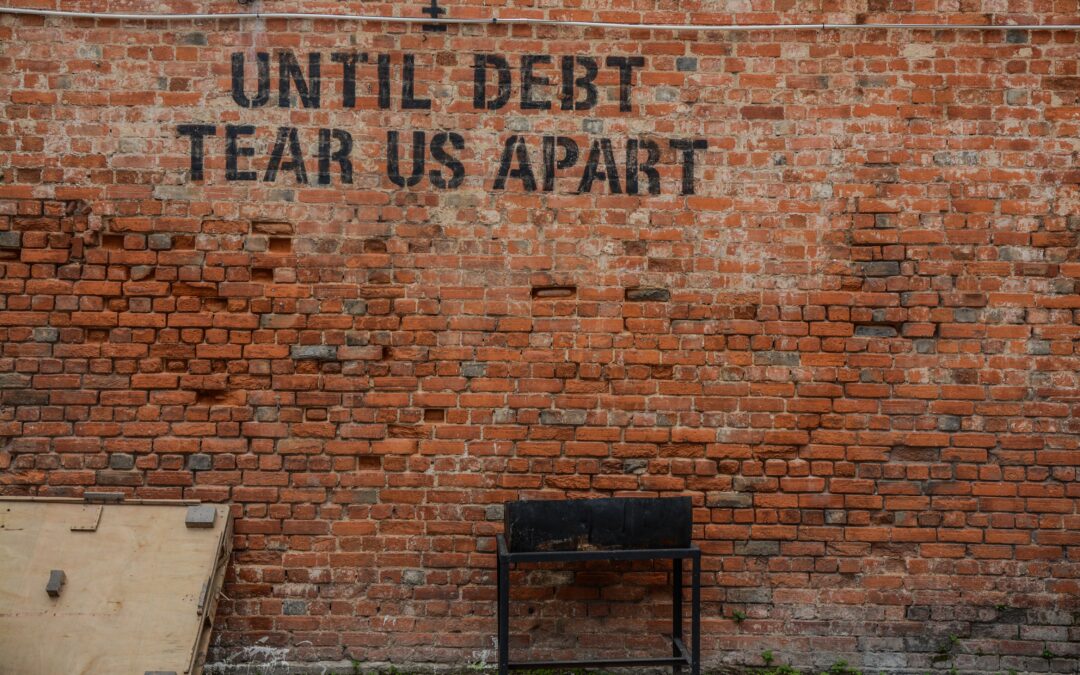

Managing finances as a family can sometimes feel like juggling, but with a well-crafted budget, you can bring financial peace and stability to your household. In this guide, we’ll walk you through the process of creating a family budget, providing practical steps to help you navigate the world of shared finances.

- Gather Financial Information: Collect income details from all sources and note all monthly expenses, debts, and savings.

- Categorize Expenses: Differentiate between fixed expenses like mortgage or rent and variable expenses such as groceries and entertainment.

- Realistic Financial Goals: As a family, decide on financial objectives, whether it’s saving for a vacation or building an emergency fund.

- Balancing Income and Expenses: Calculate total income and ensure it covers essential expenses, with a surplus allocated towards savings or other goals.

- Creating Spending Categories: Divide expenses into categories for better tracking and management.

- Prioritizing Savings: Include savings as a vital part of your budget, whether for emergencies, education, or retirement.

- Acknowledging Spending Habits: Be honest about your spending trends and discuss adjustments where necessary.

- Leveraging Budgeting Tools: Use apps and tools to facilitate budget tracking and goal setting.

- Regular Family Budget Meetings: Hold frequent meetings to review goals, spending, and make necessary adjustments.

- Flexibility in Budgeting: Stay adaptable to changes in financial circumstances or goals.

A family budget is a collaborative process that fosters financial stability and unity. By systematically gathering information, setting shared goals, and being open about spending habits, you create a budget that suits your family’s needs. Regular communication and flexibility are essential for successful family budgeting, aligning everyone towards common financial objectives.

A Step-by-Step Guide on How to Create a Family Budget

Learn more about budgeting and financial planning with Copiafy. www.copiafy.com