Table of Contents

A Simple Guide on How to Budget Money

A Simple Guide on How to Budget Money

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Embark on a journey to financial clarity with our straightforward guide to budgeting. This guide simplifies the process of managing your finances, helping you to reach your financial goals with ease.

Assess Your Income: Start by understanding your monthly income, including all sources like salary and additional earnings.

List Your Expenses: Make a comprehensive list of your monthly expenses, categorizing them into fixed and variable expenses.

Differentiate Needs and Wants: Identify what’s essential and what’s discretionary in your spending.

Set Financial Goals: Clearly define your short-term and long-term financial objectives.

Create a Realistic Budget: Develop a budget based on your income and expenses, ensuring your spending does not exceed your earnings.

Emergency Fund: Prioritize building an emergency fund to cover several months of expenses.

Regularly Review and Adjust: Keep your budget updated in response to changes in your financial situation.

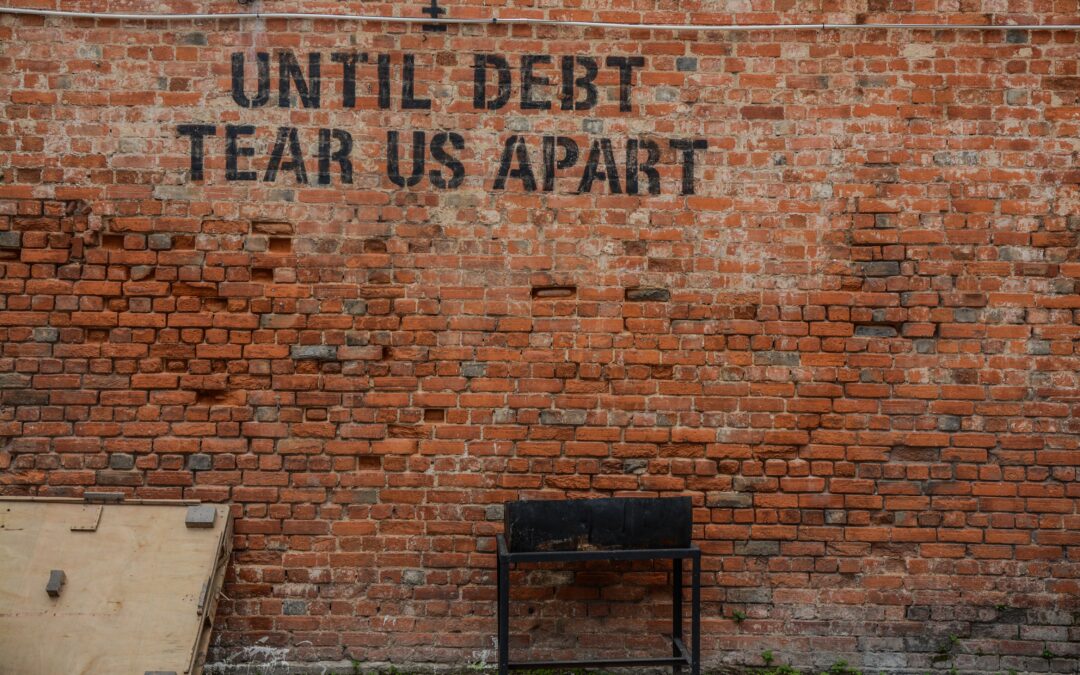

Limit Credit Card Use: Use credit cards wisely to prevent debt accumulation.

Track Your Spending: Consistently monitor your expenses to stay within budget.

Celebrate Small Wins: Acknowledge your progress in meeting financial milestones.

Budgeting is a powerful tool that empowers you to take control of your financial future. By understanding your income, prioritizing expenses, and setting goals, you can create a budget that aligns with your priorities. Remember, budgeting is not about restriction; it’s about making intentional choices that lead to financial success and peace of mind.

A Simple Guide on How to Budget Money

Learn more about budgeting and financial planning with Copiafy www.copiafy.com.