Table of Contents

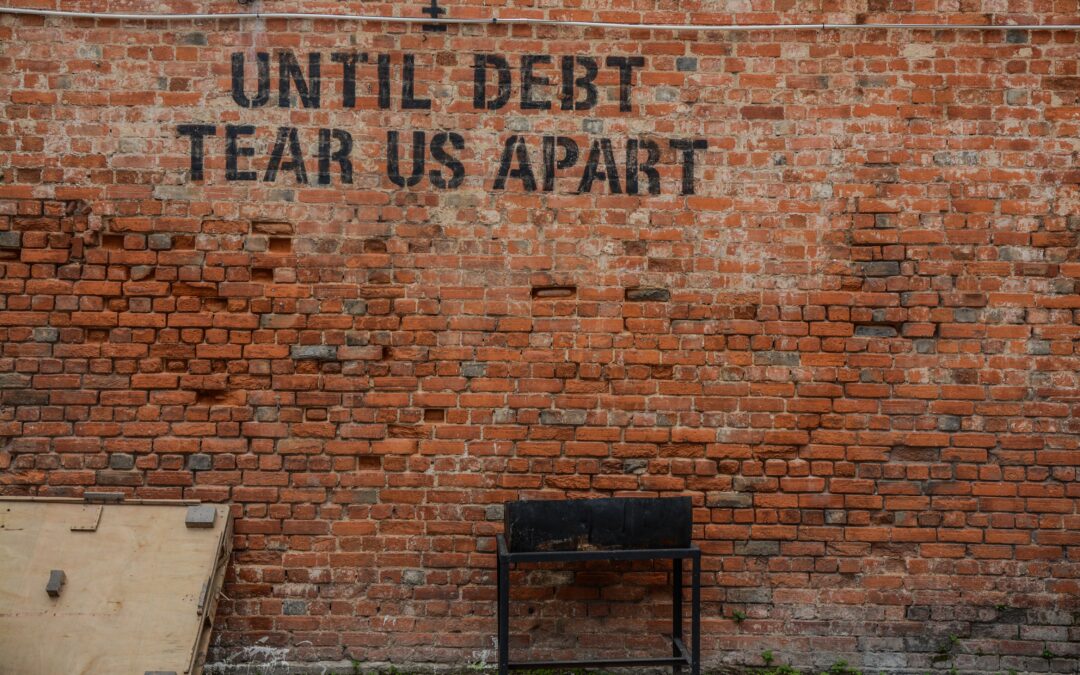

8 Tips to Paying Off Debt

8 Tips to Paying Off Debt

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

- Face Your Debts Head-On:

The first step in your debt-free journey is to confront your debts. Create a list of all your outstanding debts, including credit cards, loans, and any other obligations. Knowing the full scope of your debt is crucial for effective debt management.

- Explore Debt Repayment Tools:

Several online tools can assist you in creating a repayment plan. Consider using debt calculators to estimate payoff timelines or debt consolidation calculators to explore the potential benefits of consolidating your debts.

- Create a Realistic Budget:

Building a realistic budget is a cornerstone of successful debt repayment. Identify your monthly income and allocate specific amounts to essential expenses, savings, and debt repayment. Budgeting apps like Mint or YNAB can help you track and manage your spending effectively.

- Prioritize High-Interest Debts:

Focus on paying off high-interest debts first. The interest on these debts accumulates faster, making them costlier in the long run. By prioritizing them, you minimize the overall amount you’ll pay, accelerating your journey to debt freedom.

- Consider Debt Snowball or Avalanche Methods:

The debt snowball method involves paying off the smallest debts first, providing quick wins and building momentum. On the other hand, the debt avalanche method targets high-interest debts first, saving you more money in the long term. Choose the approach that aligns with your preferences and financial goals.

- Negotiate Interest Rates:

Reach out to your creditors to negotiate lower interest rates. A simple phone call can sometimes result in reduced rates, making it easier for you to pay off your debts. This strategy is particularly effective if you have a good payment history.

- Track Your Progress:

Celebrate small victories along the way by tracking your progress. Use debt payoff trackers or apps to visualize your journey. Seeing the reduction in your outstanding balances can provide motivation and keep you on the path to becoming debt-free.

- Seek Professional Advice:

If your debts are overwhelming, consider seeking advice from a financial counselor. They can provide personalized strategies and guidance on managing your debt, potentially helping you navigate more complex situations.

Paying off debt requires dedication and strategic planning. By utilizing online tools, creating a realistic budget, prioritizing debts, and exploring repayment methods, you can take control of your financial situation. Remember, the journey to a debt-free life is a marathon, not a sprint. With persistence and the right tools, you’ll be well on your way to achieving financial freedom.

8 Tips to Paying Off Debt

Learn more about how Copiafy can help you get closer to paying off your debt and setting yourself up for financial success www.copiafy.com