Table of Contents

12 Habits to Help You Achieve Financial Freedom

12 Habits to Help You Achieve Financial Freedom

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

- Create a Budget:

Start by creating a realistic budget that outlines your income, expenses, and savings goals. Having a clear understanding of your financial situation is the foundation for making informed decisions.

- Live Below Your Means:

Avoid the temptation to spend every dollar you earn. Living below your means allows you to save and invest for the future. It’s a key principle in building wealth over time.

- Emergency Fund:

Establishing an emergency fund is crucial. Aim to save three to six months’ worth of living expenses. This fund acts as a safety net during unexpected situations, preventing you from relying on credit cards or loans.

- Automate Savings:

Set up automatic transfers to your savings or investment accounts. This habit ensures that you consistently save a portion of your income without the need for constant manual intervention.

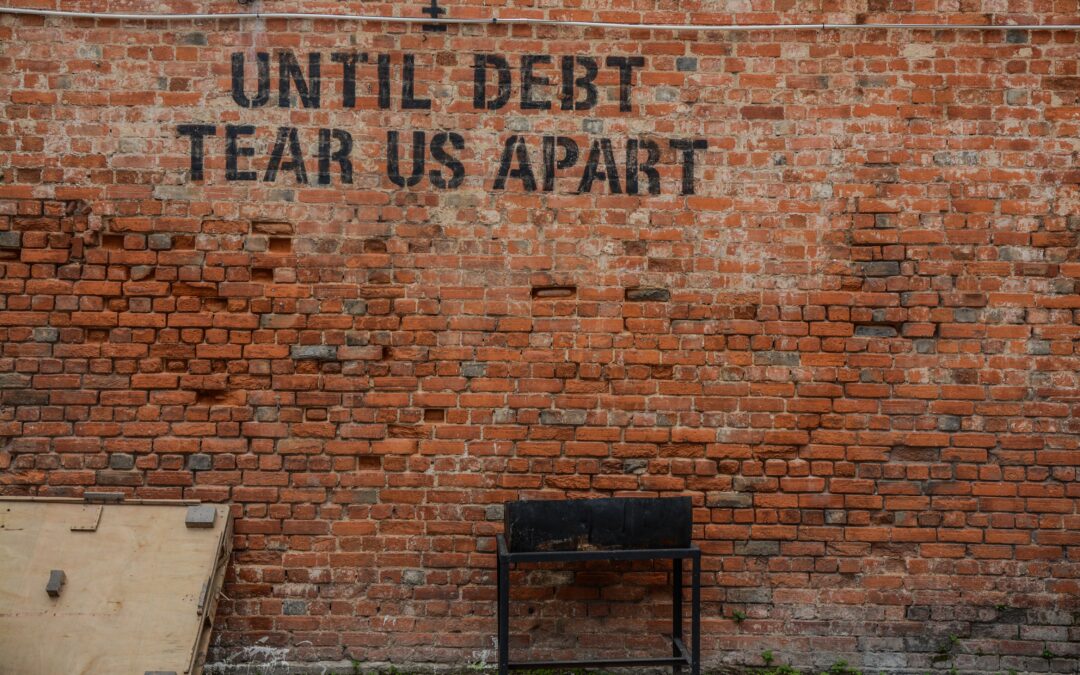

- Debt Reduction:

Prioritize paying off high-interest debt. Focus on credit cards and loans with the highest interest rates first. Once you eliminate debt, you’ll have more disposable income to allocate towards your financial goals.

- Invest Wisely:

Learn about different investment options and consider diversifying your portfolio. Long-term investments, such as stocks and mutual funds, have the potential for higher returns, helping your money grow over time.

- Continuous Learning:

Stay informed about personal finance and investment strategies. The financial landscape evolves, and keeping yourself educated ensures that you make informed decisions aligned with your goals.

- Set Financial Goals:

Clearly define short-term and long-term financial goals. Whether it’s saving for a vacation, buying a home, or planning for retirement, having specific goals provides motivation and direction.

- Set Financial Goals:

Clearly define short-term and long-term financial goals. Whether it’s saving for a vacation, buying a home, or planning for retirement, having specific goals provides motivation and direction.

- Live a Healthy Lifestyle:

Physical and mental well-being can impact your finances. Regular exercise, a balanced diet, and proper sleep contribute to increased productivity and decreased healthcare costs.

- Multiple Income Streams:

Explore opportunities for additional income, such as a side hustle or investments. Having multiple income streams can accelerate your journey towards financial freedom.

- Frugality:

Embrace frugality by making intentional spending choices. Differentiate between needs and wants, and consider alternatives to expensive habits. Small savings can add up significantly over time.

- Review and Adjust:

Regularly review your budget, goals, and investment strategy. Be flexible and adjust your plan as needed. Life circumstances change, and your financial plan should adapt accordingly.

Achieving financial freedom is a gradual process that involves cultivating positive habits and making informed decisions. By budgeting, saving, investing wisely, and embracing a frugal lifestyle, you can pave the way to a secure financial future. Remember, it’s never too late to start implementing these habits and working toward the financial freedom you desire.

12 Habits to Help You Achieve Financial Freedom

Learn more about setting yourself up for financial freedom with Copiafy www.copiafy.com.