Table of Contents

10 Ways to Improve Your Personal Finances

10 Ways to Improve Your Personal Finances

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Navigating the world of personal finance can be challenging, but with the right strategies, you can significantly enhance your financial health. This article explores ten effective ways to bolster your personal finance management, setting you on a path to greater financial security and freedom.

- Create a Budget: Begin with a clear, realistic budget that outlines your income and expenses. This helps you understand your financial situation and control your spending.

- Establish Financial Goals: Set specific, achievable financial goals, whether it’s saving for retirement, buying a home, or paying off debt.

- Build an Emergency Fund: Start an emergency fund to cover unexpected expenses, aiming for three to six months’ worth of living costs.

- Prioritize Savings: Make saving a non-negotiable part of your budget. Even small amounts can grow over time.

- Invest Wisely: Consider investing in stocks, bonds, or mutual funds to grow your wealth. Seek advice from a financial advisor to align investments with your risk tolerance and goals.

- Retirement Planning: Contribute regularly to a retirement plan, such as a 401(k) or IRA, to secure your financial future.

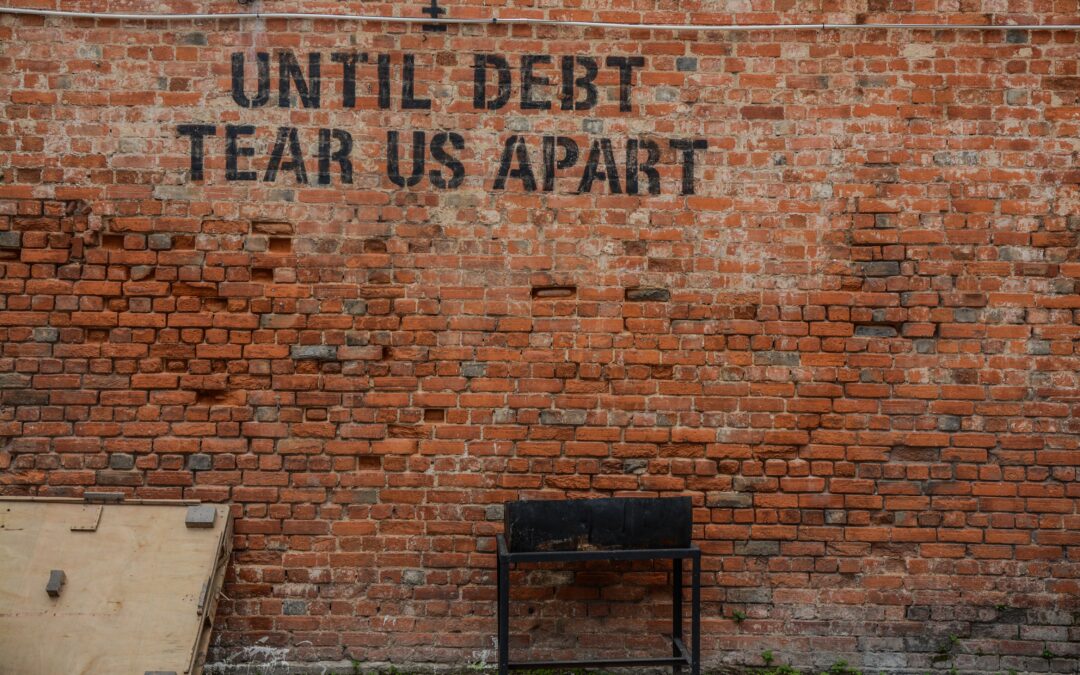

- Reduce High-Interest Debt: Work towards paying off high-interest debts, such as credit card balances, to alleviate financial strain.

- Use Credit Responsibly: Be mindful of your credit usage. Aim to pay off your credit card balance in full each month.

- Regular Financial Check-ups: Routinely review your financial plan to ensure it aligns with your changing needs and goals.

Stay Financially Informed: Keep yourself educated about financial matters. Read books, follow financial news, and attend workshops.

Seek Professional Advice: Don’t hesitate to consult with financial advisors or experts for tailored advice and strategies.

Improving your personal finance requires a mix of discipline, planning, and continual learning. By implementing these ten strategies, you can gain better control over your finances, paving the way for long-term financial health and prosperity. Remember, the journey to financial improvement is ongoing, and each step you take makes a significant difference.

10 Ways to Improve Your Personal Finances

Learn more personal finance tips with Copiafy www.copiafy.com