Table of Contents

Private vs. Federal Student Loans – Understanding the Key Differences

Private vs. Federal Student Loans – Understanding the Key Differences

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

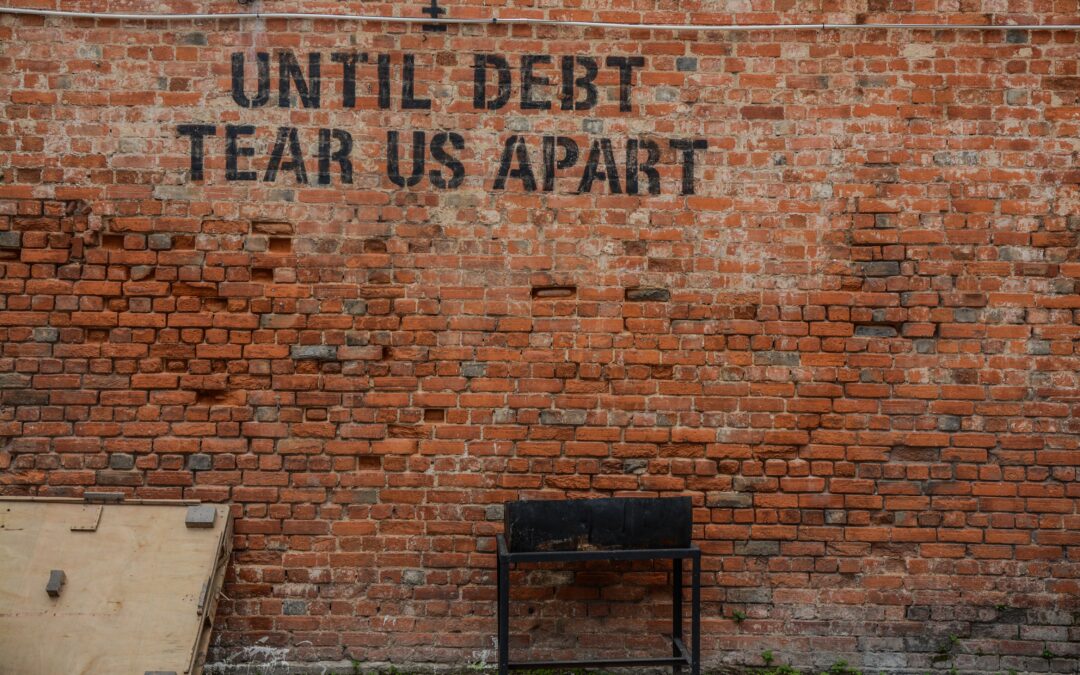

Many dream of a college education, but the financial burden seems almost unbearable. To some, the idea of taking out student loans sounds like an easy and quick fix, but to others, an unpredictable risk to take. When understood correctly, applying for student loans can be a great tool to fund your path to education.

There are two typical types of student loan options: private student loans and federal student loans. Understanding the distinctions between private and federal loans is crucial for making informed financial decisions. Let’s break down the differences between private and federal college loans to help you navigate this important aspect of higher education financing.

- Government-Backed:

Federal student loans are funded and regulated by the U.S. Department of Education. These loans are considered more secure because they are backed by the government, offering certain protections and benefits.

- Fixed Interest Rates:

Federal loans typically come with fixed interest rates, providing stability and predictability in your repayment plan. This means your interest rate remains the same throughout the life of the loan.

- Flexible Repayment Plans:

Federal loans offer various repayment plans, including Income-Driven Repayment (IDR) options that adjust your monthly payments based on your income and family size. This flexibility can be especially beneficial during times of financial hardship.

- Deferment and Forbearance Options:

Federal loans offer deferment and forbearance options, allowing you to temporarily pause or reduce your loan payments under certain circumstances, such as unemployment or economic hardship.

- Potential for Loan Forgiveness:

Some federal loan programs, such as Public Service Loan Forgiveness (PSLF), offer the potential for forgiveness of the remaining loan balance after a certain number of qualifying payments, particularly for those working in public service or non-profit jobs.

- Issued by Private Lenders:

Private student loans are issued by private financial institutions, such as banks or credit unions. Unlike federal loans, they are not backed by the government.

- Variable Interest Rates:

Private loans often come with variable interest rates, which means your interest rate may change over time based on market conditions. This can lead to fluctuations in your monthly payments and overall repayment amount.

- Limited Repayment Options:

Private loans may offer fewer repayment options compared to federal loans. While some lenders provide hardship options, the flexibility is generally more limited compared to federal programs.

- No Federal Protections:

Private loans lack many of the borrower protections that come with federal loans. There may be no deferment or forbearance options, and the terms of the loan are determined by the individual lender.

- Creditworthiness Matters:

To qualify for a private student loan, lenders typically assess your creditworthiness. This means your credit history and score play a significant role in determining your eligibility and interest rate.

- The College Investor: Offers comprehensive information about the new student loan rules for 2023, including updates on President Biden’s student loan forgiveness plan and various student loan options and programs such as the Student Loan Moratorium, Borrower Defense to Repayment, and Interest Capitalization.

- TuitionHero: Provides a detailed college student guide covering federal and private student loans. It includes information on different private student loan repayment plans such as fixed, interest, and graduated repayment. It also compares various student loan options available from lenders like College Ave, Sallie Mae, and Earnest.

- LendEDU: This guide gives an overview of federal student loans, including Direct Consolidation Loans, the Federal Perkins Loan Program, borrowing limits, and the fundamental eligibility requirements for federal student loans. It also discusses strategies for deciding how much to borrow and considerations for repayment.

- Federal Student Aid: This official government site is a primary resource for information on federal student loans, including details on different loan types, eligibility criteria, application processes, and repayment options.

Understanding the differences between private and federal college loans is essential for making sound financial decisions during your educational journey. Federal loans offer more borrower protections and flexible repayment options, while private loans may be suitable for those with a strong credit history seeking specific terms. Before taking on any student loan, take time to weigh the pros and cons and make sure it aligns with your financial goals and circumstances.

Private vs. Federal Student Loans – Understanding the Key Differences

Learn more about student loans and financial planning at Copiafy www.copiafy.com