Table of Contents

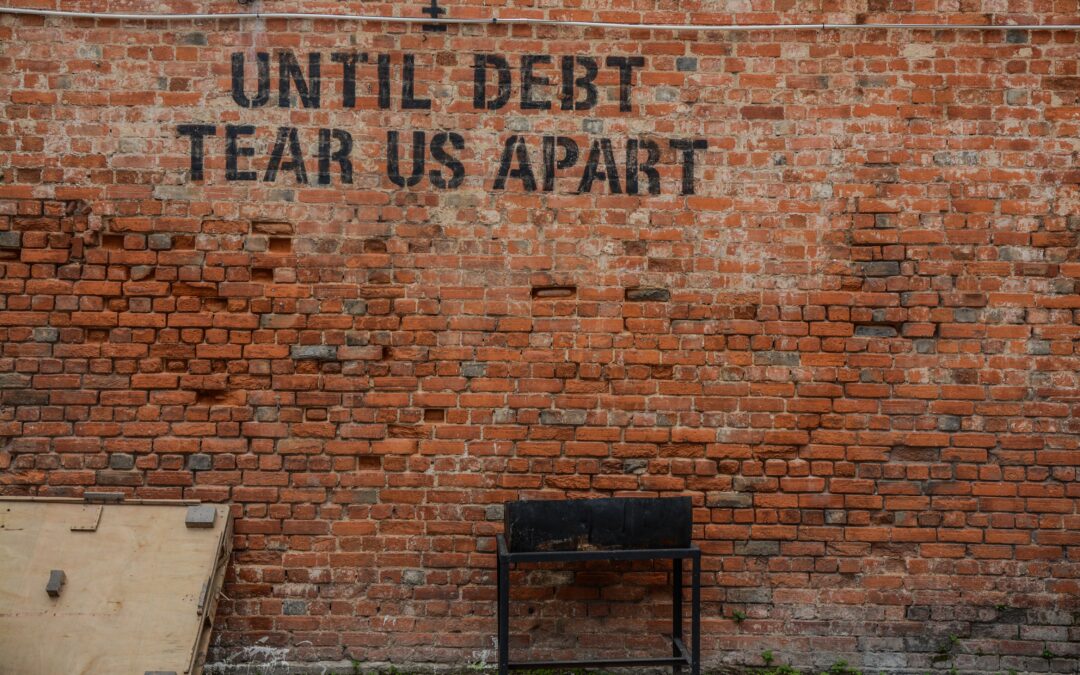

Exploring the Impact of Canceling Student Loans

Exploring the Impact of Canceling Student Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

More than 40 million Americans currently have student loan debt. Combined, this student loan debt amounts to more than $1.7 trillion. The debate over canceling student debt has gained momentum, with discussions about potential benefits and consequences. We’ll explore the impact of canceling student debt and look at the different aspects that come into play.

- Financial Relief for Borrowers:

One of the most apparent benefits of canceling student debt is immediate financial relief for borrowers. Erasing student loans could provide individuals with extra income to allocate toward savings, investments, or other essential expenses.

- Stimulus to the Economy:

The injection of money into the hands of those who had student debt could stimulate the economy. With fewer financial burdens, individuals may have more disposable income, potentially leading to increased consumer spending.

- Improved Credit Scores:

For those struggling with student loan repayments, cancelation could lead to improvements in credit scores. A higher credit score can positively impact various aspects of financial life, from securing lower interest rates to qualifying for better housing options.

- Cost to Taxpayers:

One major consideration is the cost of canceling student debt. The financial burden of forgiving large sums of student loans may fall on taxpayers, leading to discussions about the feasibility and fairness of such a proposal.

- Moral Hazard:

Some argue that canceling student debt might create a moral hazard by removing the consequences of borrowing for education. Concerns arise about the potential impact on future borrowing behavior and the responsibility of individuals to repay their debts.

- Equity and Fairness Issues:

The debate on canceling student debt also brings up questions of equity and fairness. Not everyone carries student loan debt, and some argue that blanket forgiveness may not address underlying issues or benefit those who never took on student loans.

- Targeted Relief Programs:

Rather than universal debt cancelation, policymakers may consider targeted relief programs that focus on specific groups or income levels. This approach aims to address the needs of those who may be most burdened by student debt.

- Income-Driven Repayment:

Strengthening and expanding income-driven repayment plans is another policy consideration. These plans tie loan payments to borrowers’ income, providing relief while maintaining a connection between repayment and financial capacity.

The impact of canceling student debt is a complex and multifaceted issue. While it could provide immediate relief for borrowers and stimulate economic activity, concerns about cost, moral hazard, and fairness need careful consideration.

Policymakers continue to explore various options to address the student debt crisis, aiming to strike a balance between relief and responsible fiscal management. As discussions evolve, staying informed about policy changes and potential implications is crucial for those directly impacted by student loan debt.

Exploring the Impact of Canceling Student Loans

Learn more about student debt relief and loans with Copiafy www.copiafy.com