Table of Contents

A Step-by-Step Guide on How to Pay Off Student Loans

A Step-by-Step Guide on How to Pay Off Student Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to valuable tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like personalized recommendations and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

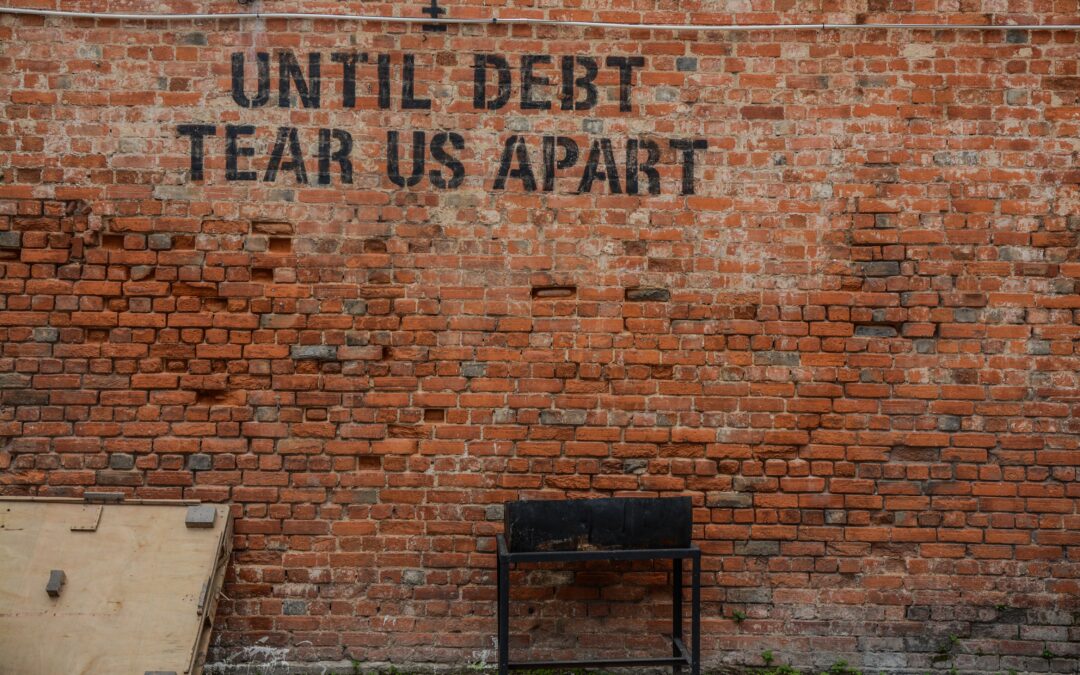

Education is so important, but not everyone is ready for the rising cost. Starting your post-graduate life is thrilling, yet student loan debt can be a source of worry. This article offers a detailed guide on strategically tackling student loans, guiding you toward a debt-free existence.

- Understand Your Loans: Gain a thorough knowledge of the types of loans you have, their interest rates, and repayment terms.

- Organize Your Loans: List all your student loans, noting details like lender, balance, and interest rates, to get a complete view of your debt.

- Create a Budget: Formulate a realistic budget by categorizing your income and expenses, which will help in allocating more funds for loan repayment.

- Repayment Plan Options: Investigate various federal loan repayment plans, such as Income-Driven Repayment (IDR), and choose the one best suited to your financial situation.

- Extra Payments: Whenever possible, make additional payments to reduce the principal balance and interest on your loans.

- Prioritize High-Interest Loans: Focus on paying off loans with higher interest rates first to minimize the total interest accrued over time.

- Loan Forgiveness Programs: Research loan forgiveness options, particularly if you’re in public service or non-profit work.

- Refinancing Options: Consider refinancing your loans for potentially lower interest rates, but weigh this against the loss of federal loan benefits.

- Understanding Grace Periods: Utilize the grace period to plan your repayment strategy effectively.

- Professional Financial Advice: If needed, seek advice from a financial counselor for personalized strategies to manage your student loans.

By understanding your debt, crafting a budget, exploring various repayment options, and utilizing additional strategies, you can effectively manage your student loans. Each step taken is a stride towards achieving financial freedom and a more secure financial future.

A Step-by-Step Guide on How to Pay Off Student Loans

Learn more about student loans and paying off debt with Copiafy www.copiafy.com